Previous practice excellence articles from the College have addressed collecting payment at the time of service and the importance of improving customer service in financial interactions with patients. And upcoming educational modules will delve into patient financial counseling and how to implement a credit card on file policy. But what do you do when your patient has an outstanding balance and you simply can’t collect? Using an outside collection agency might be the answer, but there are a few important things to consider first.

Previous practice excellence articles from the College have addressed collecting payment at the time of service and the importance of improving customer service in financial interactions with patients. And upcoming educational modules will delve into patient financial counseling and how to implement a credit card on file policy. But what do you do when your patient has an outstanding balance and you simply can’t collect? Using an outside collection agency might be the answer, but there are a few important things to consider first.

- Make sure you have an effective internal collections process.

- Determine when to turn accounts over to an outside collection agency and how you’ll let patients know.

- Decide how this will affect future patient care, and under what circumstances you will be willing to see delinquent patients again.

- Learn how to select a good collections service.

- Review your state’s collection laws to understand any debt collecting requirements.

Internal collections process

– Kay Tyler, CEO of Family Allergy and Asthma

Employing a collection agency can be costly, ranging from 20% to 50% of the amount collected, so don’t turn over accounts to a collection agency prematurely. Make sure your internal collection process is working well first. Some tips:

- Your patient financial policy should clearly spell out payment expectations.

- Flag charts of patients with delinquent balances. When these patients call or come in, be prepared to address their outstanding balance.

- Train staff on how to have financial discussions with patients and develop scripts to guide their conversations.

- Send statements to patients as soon as the patient’s responsibility has been determined.

- Some practices reward staff for collecting outstanding balances, or hold competitions to see who can collect the most past-due balances. Rewards include gift cards and pizza parties. Just make sure customer service doesn’t suffer if you go this route!

When to send an account to collections?

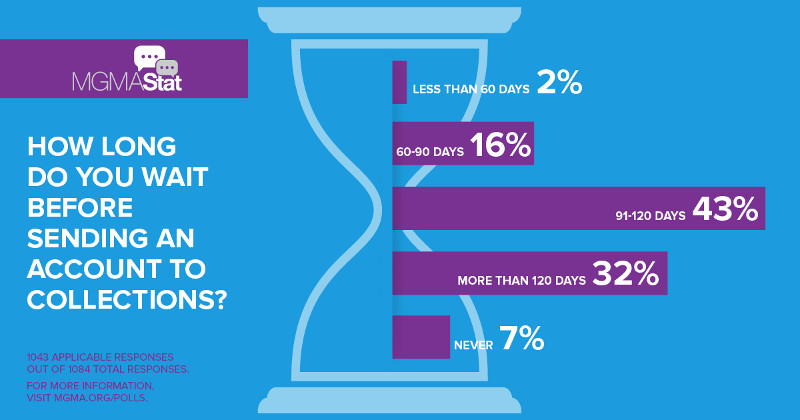

Even if your internal collections process is stellar, there will still be patients who don’t pay their bills. When should you send those accounts to a collections agency? A 2017 poll by the Medical Group Management Association (MGMA) asked health care professionals when they send patient accounts to an outside collection agency. 43% of respondents said they wait between 91-120 days before sending an account to collections, and 32% said they waited more than 120 days. Only 7% said they never turned accounts over to collections.

Source: Most Practices Wait to Send an Account to Collections, MGMA

Source: Most Practices Wait to Send an Account to Collections, MGMA

A good target for allergy practices is 90-120 days. Plan to send two bills to the patient, 30-40 days apart. The third letter should be a “termination” letter that gives the patient 30 days to pay the outstanding balance or call the practice to arrange a payment schedule. The letter should say that if the practice doesn’t hear from the patient by a specified date, the patient will be sent to an outside collection agency and terminated as a patient.

The letter should specify under what circumstances you’ll continue to see the patient. Check with your malpractice insurance, but many states require giving patients at least 30 days’ notice before terminating care. You must continue to provide urgent/emergency care for 30 days, although you may be able to refuse to see them for new, non-urgent problems.

“Sending patients to collections is never pleasant, but unfortunately necessary, as most of our practices are extending credit to patients with hope they will pay. While every account is different, try to stick to a refer-to-collections policy that is no further out than 90-120 days from your last receipt of payment,” advises Kay Tyler, CEO of Family Allergy and Asthma and vice-chair of the Practice Management Committee. “It is also best to keep the providers out of the decision-making process of which patients get referred to collections. In addition, we have found it best to use more than one collection agency as some are more successful than others.”

Sending more than three bills total to patients is costly and has diminishing returns. The older a delinquent account becomes, the less likely it is that your practice will collect on it. So make sure your internal collection process is working well first, and don’t hesitate to send patients to collections if they don’t respond to your termination letter.

How to find a good collections service

It’s important to select a collections service that is effective but will treat patients with courtesy and respect. The agency should be licensed and bonded as required by law, and should strictly adhere to all laws governing collections. The AMA Steps Forward module has a great guide on How to Select a Collection Service.

Finally, it’s a good idea to review your state’s collection laws to make sure your practice is complying with any debt collecting requirements.